Short term capital gains tax calculator

For short-term capital gains youd be at 24. The government in an effort to ease the burden of heavy taxes has also provided for certain exceptions under special circumstances.

Capital Gain Formula Calculator Examples With Excel Template

For example short-term capital losses are only deductible against short-term capital gains.

. The calculator on this page is designed to help you estimate your projected long-term capital gains tax obligation based on the income made from your assets as well as the nuances of your financial circumstances. Long-term capital gains are gains on assets you hold for more than one year. It is an umbrella term which includes land house property building patents gold equity investments and numerous other assets that generate earnings.

Short-term gains are taxed at ordinary income tax rates according to your tax bracket. The Difference Between Long-Term and Short-Term Capital Gains. The capital gains tax is a tax on individuals and corporations assets including stocks bonds real estate and property.

Check out these links for more. Types of capital gains and Mutual Funds. Additionally you can only deduct up to 3000 of net long-term capital losses in a given tax year.

It represents the length of time for which an entity owned a particular fund. The difference between a long term capital gain vs. Long-term capital gains are taxed at a lower rate than short-term gains.

As a result they might put you in a different tax bracket compared to short-term capital gains. The short term capital loss carryover from 2020 can be used to offset the long term capital gain in 2021. Long Term Capital Gains.

Typically the short term capital loss carryover would be used to offset the short term capital losses and the long term capital loss carryover would be used to offset the long term capital losses in a current year. WOWA calculates your average capital gains tax rate by dividing your capital gains tax by your total capital gains. You can also connect live via one way video to a TurboTax Live Premier tax expert with an average 12 years experience to get your questions answered along the way or.

The basic tax on long term capital gains is 20 with an addition of extra cess and surcharges like education cess whenever they are applicable. CGT means Capital Gains Tax. The tax rates for short-term capital gains are the same as those of your income tax slabs.

In a hot stock market the difference can be significant to your after-tax profits. Short-term capital gains are gains you make from selling assets that you hold for one year or less. Any excess net long-term capital losses can be carried forward until there is sufficient capital gain income or the 3000 net long-term capital loss.

Adjusted Cost Base ACB. 2022 long-term capital gains taxes can range from 0 to 20 based on your tax bracket and filing status. For example if you earn 100000 a year youre in the 15 tax bracket.

The inclusion rate for personal and business income is 100 meaning you need to pay taxes on all of your income. Theyre taxed like regular income. If you have 5000 of a short-term loss and a 1000 short-term gain the short-term loss of 5000 can be deducted against the net long-term gain if you have one.

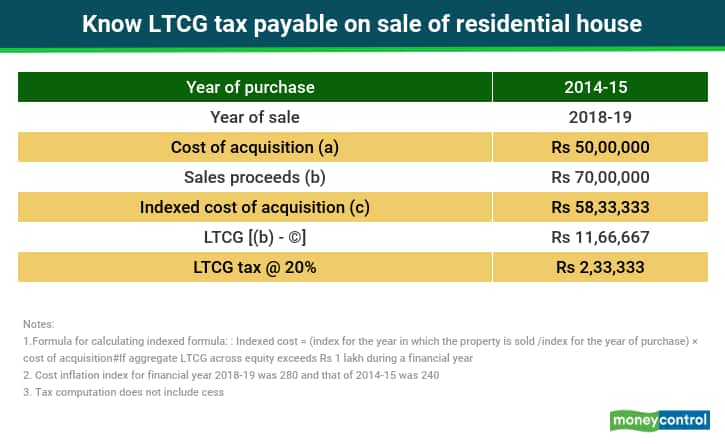

That means you pay the same tax rates you pay on federal income tax. So if you have 20000 in short-term gains and earn 100000 in salary from your day job the IRS considers your total taxable income to be 120000. Long Term capital gains from property is taxed at flat rate of 20 after taking indexation in account.

But if a net capital loss of the year is more prominent you can actually deduct up to 3000 of the loss against other forms of income like salary. Theyre taxed at lower rates than short-term capital gains. Long-term capital gains are taxed at their own long-term capital gains rates which are less than most ordinary tax rates.

These gains are bifurcated into two types long-term capital gain and short-term capital gain on Mutual Funds. The gain will be added to the existing income of such individual and taxed as per the applicable tax slab. How To Save On Capital Gains Taxes When Selling Property and All About Capital.

This is done to encourage investors to hold investments for a longer period of time. The classification of gains originates from the holding period of the sold security. The long-term capital gains tax rate is either 0 15 or 20 as of 2021 depending on your overall taxable income.

Some other types of. There is education cess of 3 effectively taking tax to 206. Under Indias Income Tax Laws when an investor decides to hold a capital asset for a period of less than 36 months it is termed as a short-term asset.

Following is an expansion on short term capital gain its calculation and its taxation under the Income Tax Act 1961. Short Term Capital Gains from. A short term capital gain is determined by.

After April 1 2018 the cess would increase to 4 taking the effective tax to 208. At tax time TurboTax Premier will guide you through your investment transactions allow you to automatically import up to 10000 stock transactions at once and figure out your gains and losses. Capital gain is the profit that an investor enjoys after selling a capital asset.

For example if you bought a property in January 2021 and sold it in May 2021 which is less than 1 year you will have to pay short-term capital gains tax on any. Selling a capital asset after owning it for less than a year results in a short-term capital gain which is taxed as ordinary income. Any short-term gains you realize are included with your other sources of income for the year for tax purposes.

The big difference between long-term and short-term capital gains is how theyre taxed. Long-term capital gains are taxed at 0 15 and 20 depending on your taxable income. Easily calculate your tax rate to make smart financial decisions Get started.

The capital gain tax calculator is a quick way to compute the capital gains tax for the tax years 2022 filing in 2023and 2021As you know everything you own as personal or investments- like your home land or household furnishings shares stocks or bonds- will fall under the term capital asset. Thanks for writing to us. Types Rate Calculation Process.

The income generated from these properties such as rent dividends interest or royalties is subject to normal income tax but the profit earned when disposing of these assets is subject to capital gains tax. If sold within 2 years its SHORT Term Capital gains or loss. An Analysis of Short Term Capital Gains on Shares.

2021 Short-Term Capital Gains Tax Rates. Tax on Long Term Capital Gains. If a property is sold within 24 months of acquiring it after 31st March 2017.

Estimate your tax refund and where you stand Get started. Short-term capital gains tax rates are generally higher than long-term capital gains tax rates. Your gains are simply added to your gross income and taxed according to your federal tax rate.

You can claim exemptions under Section 54 of the Income Tax Act. Short-Term Capital Gains Tax India 2022. However long-term capital gains are taxed at 20.

Long-term capital gains result from selling capital assets. Two types of capital gains tax which is levied on long term and short term gains starts from 10 and 15 respectively. Short-term capital gains are taxed like other ordinary income such as wages from a job.

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Capital Gains Tax Cgt Calculator For Australian Investors

Capital Gains 101 How To Calculate Transactions In Foreign Currency

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Capital Gains Tax What Is It When Do You Pay It

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

What S Your Tax Rate For Crypto Capital Gains

The Long And Short Of Capitals Gains Tax

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

Rsu Taxes Explained 4 Tax Strategies For 2022

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Capital Gains Yield Cgy Formula Calculation Example And Guide

Capital Gain Formula Calculator Examples With Excel Template

2022 Real Estate Capital Gains Calculator Internal Revenue Code Simplified

Tax Calculator Estimate Your Income Tax For 2022 Free

Short Term Vs Long Term Capital Gains White Coat Investor